Since the beginning of 2021, domestic rare earth prices have risen fiercely, and the market prices of many rare earth elements have hit record highs. At the same time, two important policies came out one after another: First, the Rare Earth Management Regulations (Draft for Solicitation of Comments) was released, which was the first legislation for the rare earth industry; second, the first batch of rare earth mining total control indicators were issued in 2021, an increase of more than 27 year-on-year. %.

How do you view the above information and the market trends predicted? Many industry insiders interviewed by a reporter from China Business News believe that the strong demand for rare earths is almost a consensus in the industry, but the current soaring rare earth prices in the short term lack rationality and "do not rule out the possibility of a fall."

Behind the huge increase in rare earth mining indicators: On February 19, the Ministry of Industry and Information Technology issued the first batch of rare earth mining total control indicators in 2021. Data show that there are 72,510 tons of rock and mineral rare earths and 11,490 tons of ionic rare earths, a total of 84,000 tons. The Ministry of Industry and Information Technology has repeatedly emphasized that rare earths are products that the country strictly implements total production control and management, and any unit or individual must not produce without targets or exceeding targets. An industry veteran who did not want to be named told China Business News that between 2010 and 2015, the amount of rare earth mining could not meet market demand. At the same time, the rare earth resource tax was relatively high. The superposition of various factors led to the "black" of illegal mining and selling. Trading in rare earths is rampant. However, after 2015, my country's crackdown on "black rare earths" has been significantly increased. Currently, illegal mining of rare earths has almost disappeared. This makes the control indicators released in two batches every year, which directly affects market conditions.

A reporter from China Business News noted that in the notices issued in 2019 and 2020 of rare earth mining targets, it was clearly stated that "the first batch of targets are calculated at 50% of the previous year's targets", and this year's notice has deleted this sentence. words. If calculated on the basis of 50% of the total control index of 140,000 tons of rare earth mining in 2020, the first batch of mining indicators in 2021 should be 70,000 tons. In fact, the first batch of mining targets in 2021 is 84,000 tons, which is 14,000 tons more than usual. Meeting the rising demand of the domestic market is considered by many insiders to be the main reason for the significant increase in mining indicators.

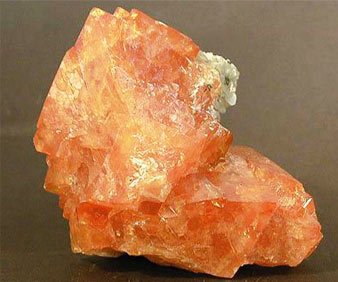

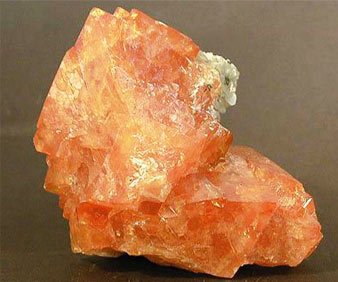

Rare earth is a general term for 17 metal elements. Rare earths, which are "industrial vitamins", are not evenly required for the various metal elements contained in them. Zhongtai Securities Research reported that the largest downstream application of rare earths is magnetic materials, accounting for about 48% of global rare earth consumption; followed by the petrochemical industry, accounting for about 12%; the remaining part is mainly used in glass, ceramics and liquid crystal polishing, etc. field. The representative of rare earth magnetic materials is neodymium iron boron permanent magnet materials. As the third-generation permanent magnet material after the first and second-generation samarium-cobalt permanent magnetic materials, NdFeB magnetic materials have the characteristics of high remanence, high coercivity and high magnetic energy product, and are widely used in wind power and new energy. Automobiles, inverter air conditioners and energy-saving elevators. Taking wind power as an example, Zheshang Securities Research reported that wind power is currently the downstream sector with the largest consumption of NdFeB magnetic materials. According to data from the National Energy Administration, the domestic new wind power installed capacity in 2020 will be 71.7 GW, a year-on-year increase of 176%, which is expected to drive the sales of NdFeB by 22,000 tons. In the future, the explosive growth of new energy vehicles will also leave room for imagination for the huge demand for NdFeB magnets.